What transpires when a chemical engineer, who’s previously crafted a hydrogen-fueled drone, ventures into being a venture capitalist? Energy Revolution Ventures (ERV), that’s what. The firm has successfully closed an $18 million seed and Series A fund to funnel capital into deep tech fields, like energy storage, carbon sequestration, and indeed, hydrogen technologies.

Marcus Clover, ERV’s co-founder and partner, shared with TechCrunch: “I pursued my studies at Cambridge, initially anticipating a career in oil and gas. Unexpectedly, I became employee No. 1 at an aerospace startup. There, we embarked on creating a hydrogen-driven drone for telecom uses.”

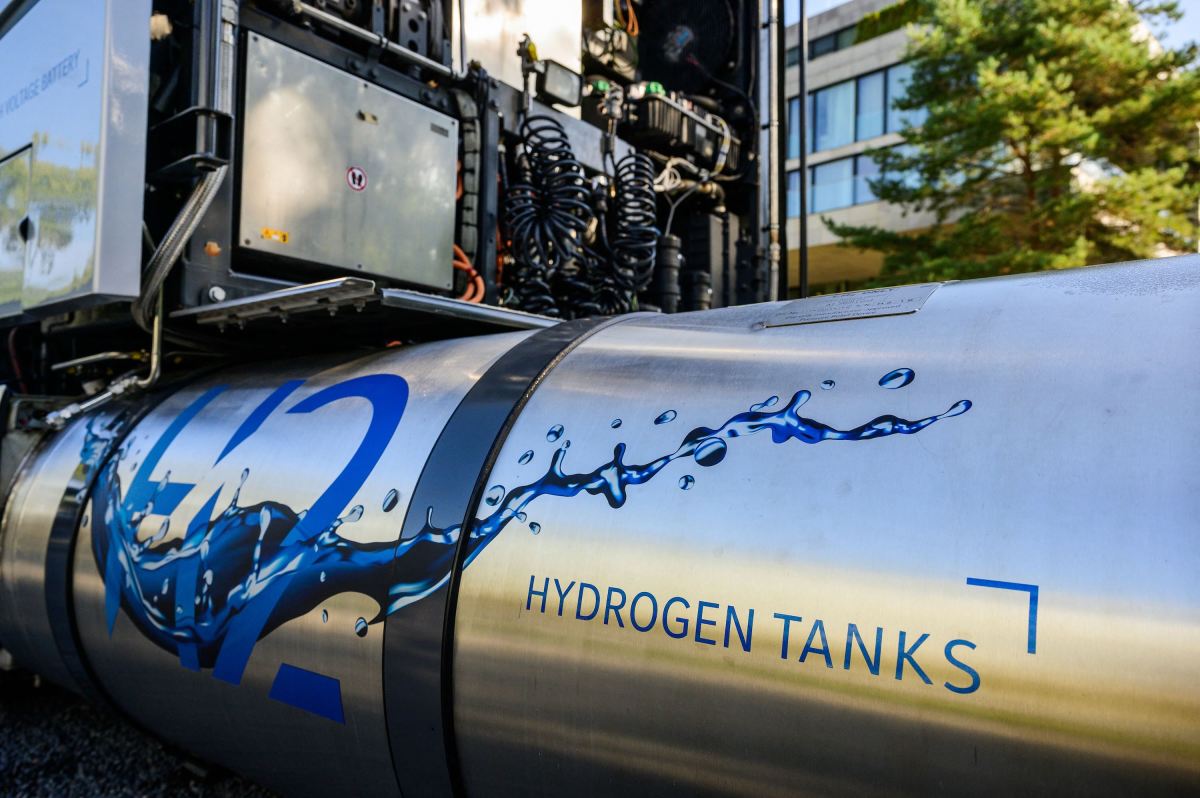

After dedicating five years to that, he moved to another enterprise implementing hydrogen fuel cells in robust vehicles: “I witnessed firsthand, as an engineer in this domain, the level of innovation underway in the energy industry. It dawned on me that I needed to shift into it from the investment angle. That’s when I joined forces with my two partners.”

The 2023 fund vintage includes partners from family offices in the metals and energy domain, affluent individuals, and Bidra Innovation Ventures, the corporate venture branch of Morocco’s OCP Group. ERV currently boasts a portfolio of nine enterprises, including Green Li-ion (expert in lithium-ion battery recycling), Anthro (focusing on structural, safe batteries), and Oort Energy (offering low-cost renewable H₂).

ERV operates both a fund and a venture creator, called Prosemino. The premise is that the fund can both inject capital into standalone startups and initiate new projects utilizing its internal technical know-how. It leverages a consortium of advisors, dispersed across the University of Oxford and University College London. It has also established specialized labs to aid its startups.

“We possess 4,000 square feet of wet chemistry and dry laboratory space here in London. To our knowledge, it’s unparalleled outside of Europe, not affiliated with a university,” Clover stated.

ERV’s approach hinges on the notion that substantial innovation is poised to occur in chemistry, particularly in the energy domain.

“During my time working with hydrogen, around 2015/2016, well before the recent hydrogen enthusiasm cycles, the pinnacle technology was within the space sector. We attempted to adapt it for aircraft. Engaging in that work imparts a lot about redesigning things from foundational ideas and functioning in compact teams with constrained budgets. I can resonate with many of the enterprises we have now backed,” explained Clover.

He noted that the firm’s hypothesis extends beyond just decarbonization, encompassing electrification: “It transcends mere electrical generation. You still need to store this energy, transmit it where it’s necessary, and subsequently electrify vast segments of the economy… We are essentially rewiring the economy, requiring vast technological support to achieve this. We observed how software made launching space rockets more affordable and efficient. I believe a parallel transformation awaits energy, and that’s the truly thrilling facet of the narrative.”

TechCrunch has highlighted two of the companies in ERV’s portfolio: Anthro Energy, whose $7.2 million seed funding was partially led by ERV, and Divigas is included in the portfolio.

Clover remarked that although certain investors concentrate on decarbonization, the progression through electrification “holds even greater excitement from a market perspective.”

Thus far, ERV Fund 1 has executed nine investments, which include:

Blixt – Developers specializing in software-enabled power electronics. The startup has been chosen to participate in NATO’s Defence Innovation Accelerator for the North Atlantic (DIANA) program.

Ecolectro – Pioneers of innovative polymers crafted for the forthcoming wave of electrolyzers in the hydrogen sector.

Immaterial – Designers of affordable and robust Metal-organic frameworks (MOFs) meant for carbon capture, gas separation, and purification objectives.