David Krane holds a highly desirable role. As head of GV, a financing entity completely bankrolled by Google at about $1 billion yearly, his squad of nearly 100 enjoys the ability to place numerous wagers — with merely a few significant limitations.

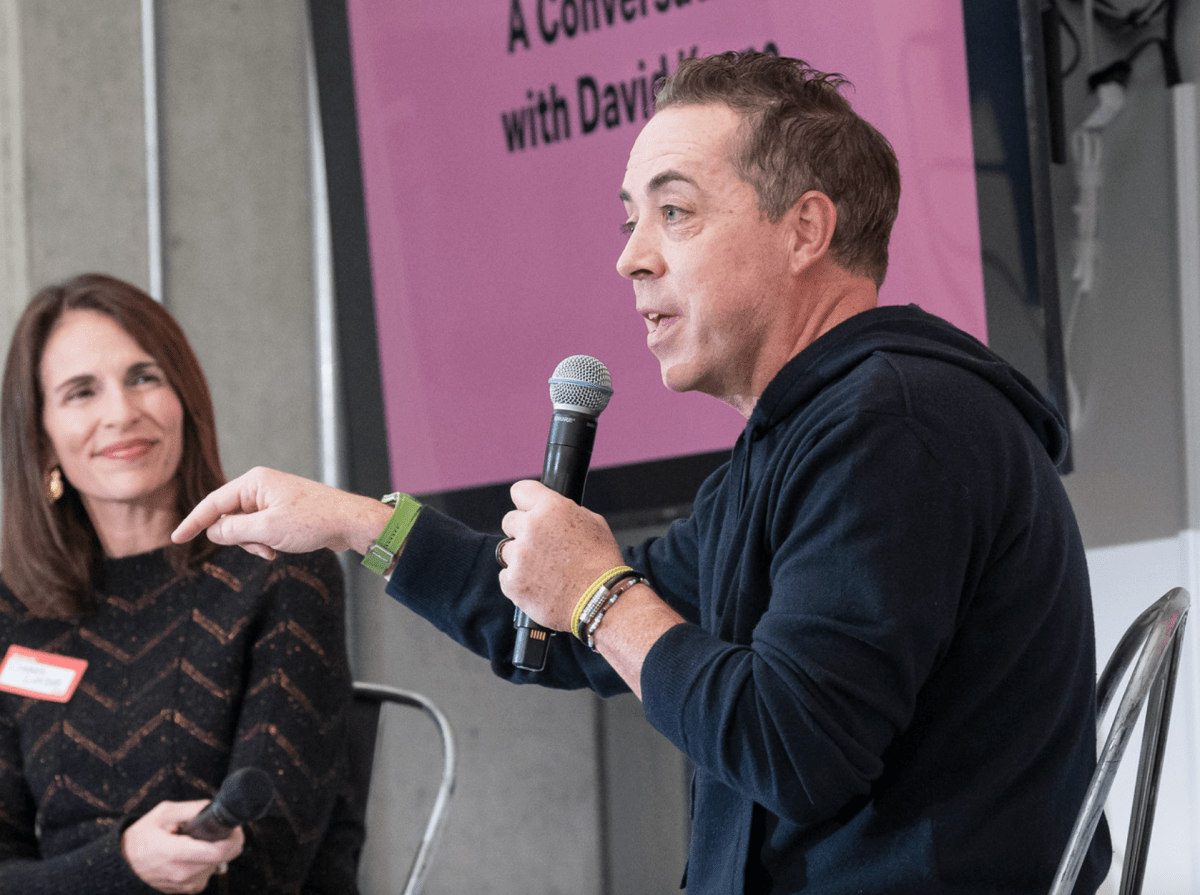

At a TechCrunch StrictlyVC gathering in San Francisco earlier this month, Krane disclosed that GV has engaged in an impressive 800 funding activities over the past five years, distributing beyond $10 billion over its 15-year existence.

None has attained as substantial a single investment as Uber, whose $258 million Series C round was entirely backed by GV back in 2013. Despite this, GV sometimes ventures into large investments, like injecting $140 million into the data infrastructure firm Cribl in August to partake in a $319 million Series E round.

In truth, Krane notes, since GV invests solely for lucrative returns, there are minimal restrictions on its conduct. Thus far, GV has predominantly funded projects within the U.S., however, it has also allocated about half a billion to its second-largest marketplace, Europe. This strategy has led to dedicating half its efforts to life sciences, healthcare, and biotech, while the remaining half is centered around a comprehensive “digital” category.

This level of independence has also meant not having to contend with a clear division that separates what GV is able to fund from what Alphabet’s mature-stage branch, CapitalG, finances.

When asked if the two divisions ever jostle for opportunities to participate in deals or secure a larger stake in a company — with both factions holding investments in Stripe, Cribl, and various other companies — Krane refuted the notion, indicating that since both “are funded by the identical source,” the core principle is “communicate effectively.”

Indeed, one of the few clear prohibitions is actively luring talent from within Google to establish a company purely so that GV can be its initial financier.

We inquired while discussing members of Google’s AI-driven note-taking application NotebookLM, who have recently departed to launch their own venture, news of which TechCrunch revealed on the day of our dialogue with Krane. Wondering aloud if GV would finance them, Krane remarked: “We are acquainted with some individuals on the NotebookLM team, unquestionably, and we did have awareness about this team that would be spinning off.”

“From time to time, groups depart from Google to chase after a startup, and GV takes notice and chooses to engage,” he further commented. However, he clarified, “… We haven’t established a robust vacuum specifically to persuade folks to exit Alphabet and begin startups, though it does indeed happen. There exists an impressively large diaspora of individuals who spent time in portions of Alphabet and are now running startups, many of whom are within our networks, and we have financed some of them.”

Upon inquiry on Google’s stance regarding GV writing substantial checks to individuals on their path out — an act that maintains them in proximity to the parent company yet can motivate them to venture independently — Krane elaborated: “Indeed, I believe that’s precisely accurate. The intent is to remain at Google if one is currently within Google and to create transformative products.” But “people don’t remain indefinitely,” he observed. “That is an inevitable reality. Individuals part ways. People pursue startups, and then we might participate in that dialogue.”

For additional information, consider listening to the comprehensive discussion.

Revision: This account initially suggested that GV also steered clear of backing direct rivals to Google, such as OpenAI; the organization requested clarification that GV indeed invests in startups that pose direct competition to a portion of Google.