Numerous VCs, especially those newer firms, openly acknowledge that 2024 has posed difficulties for securing new funding.

Dimension Capital, a venture entity established two years ago, encountered a different scenario when aiming to raise its second fund.

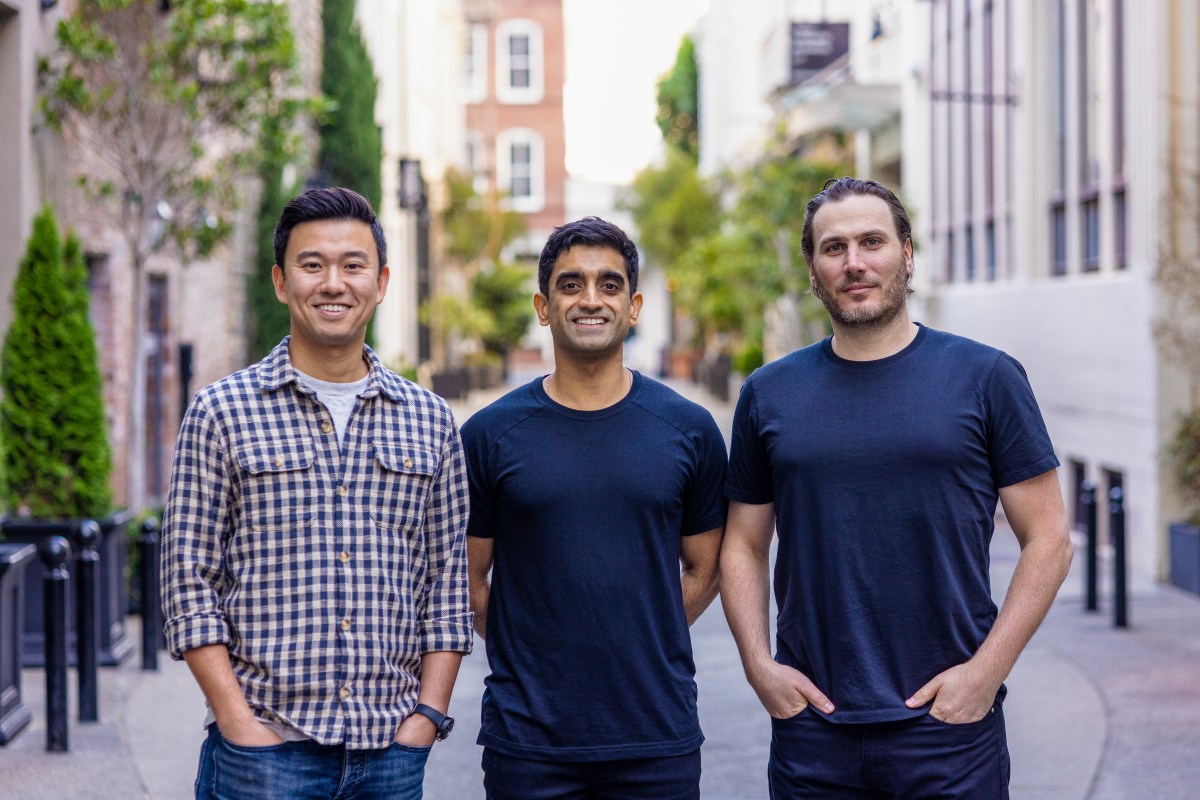

“All investors from our initial fund returned swiftly,” conveyed Zavian Dar (depicted center), one of the founding trio and managing partners of the firm. Dimension also introduced a handful of fresh investors but ultimately “turned away the overwhelming majority of LPs who showed interest.”

Not quite two years meanwhile its first $350 million fund closing, Dimension communicated it has successfully secured an oversubscribed $500 million fund, surpassing its aim of $400 million.

The allure of Dimension lies in its distinct concentration on the intersection of life sciences and technology, a sector that has steadily captured interest over recent years as the advent of drug discovery through AI (alongside a more significant shift toward embedding AI into clinical uses) appears more attainable than ever. Dar claims that their firm stands as the premier VC solely devoted to “closing the divide” between biology and computer science.

Since the 2022 inception, founded by Dar, formerly of Lux Capital as a general partner; along with Adam Goulburn (found on the right), another Lux associate, and Nan Li (spotted on the left), once of Obvious Ventures, Dimension has put investments into nearly 20 businesses. Roughly half remain in stealth mode.

Of the firm’s visible portfolio entities, there’s Chai Discovery, a startup crafting an open-source AI foundational model geared toward drug discovery. In September, Chai secured $30 million in seed financing, spearheaded by Thrive Capital and OpenAI, with Dimension’s engagement. The firm has also supported Enveda Biosciences, a biotech outfit leveraging AI to synthesize medicines from natural substances, which last month amassed a $130 million Series C.

Upon its initiation, the partners stated an emphasis on early-stage ventures. The focus since expanded into all development phases, spanning from commencement to public enterprises. Dimension invested in Monte Rosa, which is publicly listed and employs AI technologies for drug creation.

This stage-indifferent strategy affirms Dimension’s capacity to draft checks from a modest million to upwards of $30 million or greater. Similar to the first fund, the subsequent one anticipates holding a portfolio of about 20 ventures.

Currently, Dimension’s investments are fairly divided between companies involved in drug discovery and those creating software and infrastructure aiding biopharma, such as an ongoing clandestine startup developing robotic systems for lab experiment automation.

Dimension Capital opted not to disclose LPs’ identities but indicated that their roster generally includes endowments, healthcare facilities, and research entities among others.

Contrary to many life sciences VCs, Dimension will choose to invest in biotech startups only when teams consist of at least “25%, 30%, or even 40% computational biologists,” according to Goulburn. “They are machine learning specialists, AI technicians, hardware roboticists all working in harmony with chemists and biologists in drug development.”

Dar expressed admiration for the entrepreneurs venturing into the field.

“One impressive aspect of this period is the caliber of entrepreneurs,” he noted. “These highly driven, technically skilled, and scientifically informed individuals are entering this domain.”